“What’s the simplest, most cost-effective way for my business to accept credit card payments?”

If this question is lurking around, we get it. Figuring out how to accept credit card payments can feel overwhelming for any retailer. You see a customer hold up a card, and you just want to say “yes” without worrying about complex contracts, bulky hardware, or sky-high fees.

This guide is all about actionable steps you need on how to accept credit card payments without a merchant account headache.

The goal isn’t just to accept card payments. The goal is to make every transaction work harder for your business. Let’s get you started.

How to Accept Credit Card Payments: A Quick Overview

To accept credit card payments for your business, you need two things:

1. A Card Processing Provider

This is the company that processes the transaction.

2. A Way to Collect Payment Information

The three most common options are 1) a point-of-sale (POS) system with a card reader, 2) a dedicated card terminal, or 3) a payment gateway (for online shops).

How to Set Up Credit Card Payments for Your Business

Getting your system ready to accept credit cards might seem like a big project, but it’s just a few clear steps. Follow this process, and you’ll be set up for success.

1. Select a Payment Processor

This is your first and most important choice. Your payment processor is the company that handles the transaction between you, the customer, and the banks. Choose a processor that’s reliable and cost-effective. Look for one that specializes in retail, like FTx Card Payments, to help you accept card payments with clarity and lower fees.

2. Open a Merchant Account

To receive payments by credit card, you usually need a merchant account. Think of it as a temporary holding pen for your money before it gets deposited into your business bank account. This account lets you receive payments by credit card before funds reach your bank. Your processor usually helps set this up quickly.

3. Set Up Your Payment System

Now for the hardware. This is what your customers will see and interact with. You’ll need a terminal or a POS system that can read cards. An all-in-one solution like FTx POS includes everything you need – terminal, scanner, cash drawer – so you can start to accept credit card payments without hassle.

4. Integrate the Payment System

This step is about connection. Your payment terminal needs to talk to your point-of-sale system and, crucially, your bottom line. A fully integrated system means every sale automatically updates your inventory, tracks customer purchases for loyalty points, and records the data for accurate reporting. It’s how you move from just being able to accept credit card payments to truly understanding your business.

5. Test Transactions

Before you go live, you have to run test sales and refunds. Run a few small transactions using different card types (debit, credit, contactless) and process refunds. Make sure payments go through, receipts print, inventory updates, and the sale correctly appears in your reports. Testing prevents problems when real customers come.

6. Stay Compliant and Secure

This isn’t a one-time step; it’s an ongoing responsibility. You must follow industry standards – like PCI DSS (Payment Card Industry Data Security Standard) compliance –which sets strict rules for handling, processing, and storing cardholder data. These standards are designed to protect your customers and your business from fraud. Meeting them involves using secure, encrypted systems and, in many cases, completing an annual self-assessment. Compliance isn’t optional – it’s essential whenever you accept card payments.

Key Participants in the Credit Card Payment Process

A single card swipe involves several key players working behind the scenes. Here’s who they are and what they do for you.

The Merchant (You)

That’s you. Your job is to provide the product or service and use a secure system to accept credit card payments. You get paid for the sale, minus processing fees.

The Customer (Cardholder)

The person making a purchase with their debit or credit card. Their bank guarantees the funds to complete the transaction with you.

Acquiring Bank (Merchant’s Bank)

This is your business bank. It holds your merchant account and is responsible for depositing the funds from accepting credit cards into your account.

Issuing Bank (Customer’s Bank)

The institution that gave your customer their card. It authorizes the transaction, verifying the customer has enough credit or funds to pay, and later bills the customer.

Credit Card Associations (Card Networks)

Companies like Visa, Mastercard, and American Express make the most of association. They set the rules, facilitate the transaction between banks, and determine the interchange fees, but don’t directly process payments.

Payment Processor

The technology provider that acts as the messenger. They securely transmit the transaction data between you, the banks, and the card networks to make sure you can process card payments quickly and reliably. This is where a solution like FTx Card Payments operates.

How Does Credit Card Processing Work?

Credit card processing involves several steps to ensure a smooth and secure transaction:

1. Transaction initiation

The customer swipes, dips, taps, or enters their credit card information.

2. Authorization

The merchant transmits the transaction details to the payment processor, which verifies with the issuing bank if sufficient funds are available and approves the transaction.

3. Batching

Approved transactions are grouped into batches for settlement with the issuing bank.

4. Clearing and settlement

The issuing bank transfers funds to the merchant’s account minus processing fees.

5. Fees and charges

Several fees are involved in credit card processing, including interchange fees paid to issuing banks and processing fees paid to the payment processor.

6. Security and compliance

Secure communication protocols and encryption are used to protect sensitive credit card information.

7. Disputes and chargebacks

In case of disputes or fraudulent transactions, chargebacks may occur where funds are reversed from the merchant’s account.

8. Finalization

The transaction is finalized after settlement with the issuing bank.

What do payment processors do?

Learn how payment processors work behind the scenes to process card transactions and fine-tune the best practices of payment processing for businesses.

Read: Integrated Payment Processing: Everything You Need to Know About

Types of Credit Card Processors

The type of processor you work with is dependent on 1) whether you will be selling in-store or online, 2) the transaction volume, and 3) the cards/ payment options you want to accept.

The most common types of credit card payment processors include:

- POS Providers – The best retail POS systems include credit card processing. Payment processing is a feature of the system, along with inventory management tools, customer relationship management (CRM) tools, and analytics tools.

- Payment Gateways – Payment gateways are necessary for accepting credit card payments online. These networks handle the transfer of payment information between the merchant’s website and the credit card network. Authorize.net is an example.

- Merchant Account Providers: These are traditional banks or financial institutions that provide businesses with merchant services accounts. This account allows businesses to accept debit card and credit payments. Chase Paymentech is an example.

- All-in-One Processors – These systems combine merchant services and payment gateways. These systems are user-friendly and require minimal setup. Stripe is an example.

You don’t need a separate terminal or device to handle credit card and electronic payments. This streamlines the checkout process, reduces errors, and creates a more seamless customer experience.

These are just the most common types. For example, a high-risk payment processor is another option, which offers credit card services for businesses in industries with a higher risk for fraud or chargebacks. High-risk providers generally charge higher credit card processing fees. For example, credit card processing for smoke shops may be subject to high-risk fees.

Types of Credit Card Payment Options

There are different types of payment options available for businesses to accept credit card payments. These include:

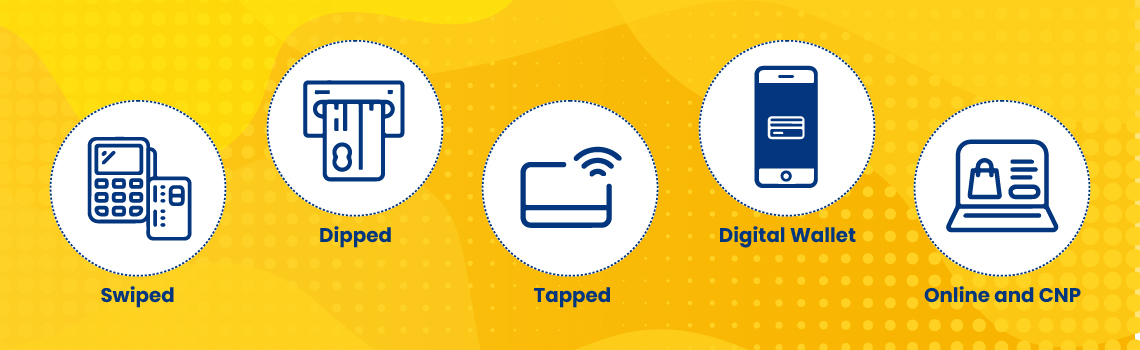

Here’s a breakdown of the different ways you can use your credit card:

- Swiped Transactions: This traditional method involves physically swiping your magnetic stripe credit card through a card reader at a checkout terminal.

- Dipped Transactions: For cards with embedded chips, you “dip” the card into a chip reader, which provides enhanced security.

- Tapped Transactions: Many cards with contactless payment technology allow you to simply tap your card on a designated reader for a quick and easy transaction.

- Digital Wallet Transactions: Use digital wallets like Apple Pay, Google Pay, or Samsung Pay to securely store your credit card information on your smartphone and make contactless payments.

- Online and CNP (Card Not Present) Transactions: For online purchases or phone orders, you enter your credit card details directly on the website or over the phone.

Payment Provider vs. Merchant Account

Choosing between a payment provider and a merchant account depends on your business’s priorities.

Payment providers offer easy setup, integrated tools, and flexibility for startups and businesses with limited technical expertise. However, they often have higher transaction fees and limited control.

On the other hand, merchant accounts offer lower fees for larger transaction volumes, customization options for checkout experiences, and direct fund deposits. Yet, they require a more complex setup, potentially involving credit checks and longer approval times, and might suit businesses with technical know-how and a need for control. Evaluate your business needs before deciding.

Choosing a Credit Card Payment Processor

Although competitive rates are a deciding factor, there are many other considerations to make when choosing a processing company. Here are some factors to consider:

- Rates – Credit card processors charge fees for each transaction. Don’t just choose the lowest transaction fees; be sure you understand the overall cost and if there are hidden costs like annual fees, minimums, etc.

- Reliable Customer Service – A glitch during peak business hours can be disastrous. Ensure your processor is always reachable. (This is also why it can be difficult to work with a large company).

- Technology – The best companies utilize the latest security technology, offer tools like NFC (near-field communication) scanners for accepting mobile payments, and more. Choose a company that provides access to the latest payment options and advanced payment tech.

Tip

Pro Tip. Choose a system with integrated credit card processing in your POS, which is a key benefit of a POS system with integrated processing vs POS + third-party processor. The best marriage is a POS that offers card processing services However, if you choose a third-party payment processor, be sure they offer support for your existing POS system.

How to Accept Credit Card Payments?

There are several ways for businesses to accept credit card payments:

- In-store: Traditional card readers allow customers to swipe, dip, or tap their cards for in-person purchases.

- Online payments: Businesses can integrate a payment gateway with their website to securely process online credit card transactions.

- Credit vs. Debit Card Transactions: Both credit and debit cards can be used for payments, but credit cards offer a line of credit you repay later, while debit cards deduct funds directly from your checking account.

- Payment Gateways vs. Merchant Accounts: Payment gateways facilitate secure online transactions, while merchant accounts handle the financial aspects and receive funds from credit card companies.

Payment Processing Fees: What to Expect

Payment processing costs and fees vary widely depending on the payment provider, the type of transaction, the payment method used, and other factors. Generally, payment processing fees include:

1. Merchant Account Fees

A merchant account includes a monthly fee. These fees include account maintenance charges, statement fees, and/or gateway access fees.

2. Transaction Fees

This is a fee for each individual transaction. It can be a fixed fee, a percentage of the transaction amount, or a combination of both. These fees cover the costs of processing the payment.

3. Interchange Fees

The card-issuing bank may charge the merchant’s bank a processing fee. Interchange fees vary based on factors like the type of card (credit, debit, rewards, etc.), the transaction method (card-present, card-not-present), and the industry. American Express, for example, has a higher interchange fee.

4. Assessment Fees

Card networks charge assessment fees. Typically, these are fixed fees that vary based on the network and the type of card.

5. Chargeback Fees

Chargeback fees occur when a customer disputes a transaction. Merchants often have to pay a fee for each chargeback to cover administrative costs.

Other Fees

In addition, there are some less common fees you should be familiar with. These fees occur based on the type of account you have:

- Cross-Border Fees: If you’re processing international payments, there might be additional fees for currency conversion, cross-border transactions, and compliance with international regulations.

- Monthly Minimum Fees: Some payment processors might require a minimum processing volume each month. Some payment processors set a monthly minimum for transactions. If your business doesn’t reach that amount, they may add extra fees to make up the difference.

- Gateway Fees: If you’re using a payment gateway to securely transmit payment data between your website and the payment processor, there might be associated gateway fees.

- Additional Services: Some payment processors offer additional services such as fraud protection, subscription management, and reporting tools. These services might come with their own fees.

To get specific information about payment processing costs and fees, it’s best to contact payment processing providers directly and ask for a detailed breakdown of their pricing structure based on your business’s needs.

What Does It Cost Per Transaction?

The cost per transaction that you pay can vary significantly. This is generally dependent on the volume of transactions your business does and the provider’s fee structure. However, most credit card processors structure their fees using one of the following methods:

- Flat Fee: Some payment processors charge a flat fee per transaction. This fee could range from around $0.20 to $0.50 per transaction, regardless of the transaction amount. This model is common among providers targeting smaller businesses and online startups.

- Percentage Fee: The most common structure. Your processor charges a percentage fee based on the transaction amount. This percentage could be around 2% to 3% of the total transaction. This model is good for larger businesses and those with higher transaction volumes.

- Tiered Pricing: Some processors use a tiered pricing model where the percentage fee depends on the type of card used for the transaction. The fee might be lower for debit cards and higher for rewards cards.

- Interchange-Plus Pricing: This model provides transparency by passing on the actual interchange fees from the card networks along with a separate markup set by the payment processor. This markup is a fixed percentage over the interchange cost, plus a flat fee.

- High-Risk Business Fees: If your business is high-risk due to your industry or other factors, you might face higher transaction fees to account for the increased risk. This is common for products like kratom, electronics, or other industries prone to fraud.

Tip

Pro Tip. Always be aware of the fees that your credit card processor will charge you. Generally, you’ll want to ask about annual or membership fees, or if there are minimums per transaction. However, you’ll also want to focus on strategies to reduce processing costs, like dual pricing or cash discounts.

Get Started with FTx Card Payments

Tired of your payment system being a cost center instead of a growth engine?

Let’s talk about your bottom line. Every time a customer pays by card, a chunk of your profit disappears into processing fees, complex hardware, and disconnected systems. What if you could flip the script? What if your payment system actually helped you save money and sell more? That’s the shift FTx Card Payments delivers. We don’t just help you accept credit card payments; we help you optimize them.

Core Benefits of FTx Card Payments

Serious Savings on Rates

Our mission is to keep your money in your pocket. We offer some of the most competitive rates in the industry. Every dollar saved on fees is a dollar straight back to your profit.

Zero Hardware Hassle

Forget old-fashioned, mismatched terminals. FTx Card Payments is seamlessly integrated into the all-in-one FTx POS system. One unified kit, one reliable provider. It works right out of the box.

Smart Integration = Smarter Sales

This is the real advantage. When you process card payments with us, the transaction doesn’t just end. It automatically updates inventory, triggers loyalty rewards in Loyal-n-Save, and feeds data into FTx BI Analytics for smarter forecasting. Your payment terminal becomes your hardest-working employee.

Security Simplified

We handle the heavy lifting of PCI compliance and security. Our encrypted systems protect you and your customers from fraud, giving everyone peace of mind with every tap, dip, or swipe.

Direct Support, Not Call Centers

Get expert help from a team that understands retail. We solve problems fast with the shortest turnaround time.

Who Should Switch to FTx POS?

If you’re serious about retail, this system is for you. It’s built for the specific, tough demands of:

- High-volume convenience stores and groceries that need speed and reliable inventory tracking.

- Liquor and tobacco stores that require seamless, built-in age verification (FTx Identity) to stay compliant.

- Salons and specialty retailers that thrive on customer loyalty programs and upselling opportunities with our Loyal-n-Save rewards program.

Still in doubt? Check this out >>> Make Your POS System Work For You!

FAQs

Getting started with FTx Card Payments is straightforward.

In general, you’ll need:

1. A Business Bank Account: This is where your credit card sales funds will be deposited.

2. Basic Business Information: This includes your legal business name, address, and Employer Identification Number (EIN) or Social Security Number.

3. Optional: An FTx POS System: While you don’t technically need an FTx POS to process payments, FTx customers can enjoy the added benefit of fully integrating card payments directly into their POS. This allows transactions to automatically update sales, inventory, and other connected features, all from one system. Once your application is approved, you’ll receive your card reader and can begin accepting payments securely.

This depends on your local regulations and your business structure. While some sole proprietors operating under their own name may not always need one, most established businesses are required to have a business license.

More importantly, payment processors like FTx are required by our banking partners to verify the legitimacy of your business. A business license is a key document that helps us do this quickly and securely, protecting both you and the financial ecosystem. We always recommend checking with your local city or county clerk and operating with the proper credentials.

Today's customers expect flexibility. FTx POS empowers you to meet them wherever they are:

- In-Person (Card-Present): Use our sleek, secure countertop terminals or mobile readers for tap, dip, or swipe payments. These transactions have lower rates due to reduced fraud risk.

- Online (Card-Not-Present): Accept payments on your website through our seamless, integrated payment gateway.

We believe in transparent pricing.

Costs are typically a combination of:

- Interchange Fees: These are rates set by card networks (Visa, Mastercard) and are non-negotiable. They vary based on card type and how it's entered (e.g., tapped vs. keyed).

- Assessment Fees: A small percentage paid to the card networks themselves.

- Processor Markup: This is FTx's fee for our technology, security, and service.

For FTx Card Payments:

- In-store starting at - 2.59% + .10¢

- Online starting at - 3.75% + .35¢

Think of a payment gateway as the secure digital cashier for your online store. It's the technology that encrypts your customer's payment details at the point of entry and securely shuttles that data between your website, the card networks, and your bank.

FTx includes a fully integrated, PCI-compliant gateway with every plan, ensuring your online transactions are just as secure and simple as your in-person ones.

This is a common point of confusion!

A merchant account is a special type of bank account that temporarily holds funds from credit card sales before they're transferred to your business bank account (usually within 1-2 business days).

A payment processor (like FTx) is the company that provides the technology and service to facilitate the transaction. We manage the complex communication between the terminal, banks, and card networks, ensure security, and handle the settlement of funds into your merchant account.

With FTx POS, absolutely. Security isn't a feature; it's our foundation.

We protect your business and your customers with:

- End-to-End Encryption (E2EE): Data is scrambled the moment a card is dipped or tapped.

- PCI DSS Compliance: We are certified to the highest payment security standards, and we will guide you to maintain your compliance easily.

- Tokenization: We replace sensitive card data with a unique, useless "token," so your system never stores vulnerable information.

- Advanced Fraud Detection: Our systems monitor transactions in real-time to flag and prevent suspicious activity.

Choose a partner, not just a provider.

Look for:

- Transparent Pricing: No hidden fees (a core FTx promise).

- Integrated Solutions: A unified system for in-person, online, and multichannel sales.

- Robust Security: PCI compliance and advanced fraud tools should be standard.

- Reliable Customer Support: Access to knowledgeable, U.S.-based support when you need it.

- Modern Hardware & Software: A system that's intuitive for you and delivers a fast, professional experience for your customers.

- Scalability: A provider that can grow with you, adding features like inventory management, customer loyalty programs, and detailed analytics.