Buy the Best Point-of-Sale Card Reader for Your Business: Compare, Choose & Get Set Up Fast

If you’re still handing customers a swipe-only device or manually typing in card numbers, you’re…

Read More >>

For businesses, accepting credit card payments is no longer optional. In fact, businesses that don’t accept them risk being left behind.

To accept card payments online, you’ll need a credit card acceptance solution like a payment processor. This is a company that processes the transaction and makes sure the funds land in your business bank account.

Businesses accept credit card payments using a payment processor. When a customer swipes their card, the processor verifies the details, checks for sufficient funds, and then approves or declines the transaction. If a transaction is approved, the processor transfers the payment amount from the customer’s account to the business’s. In this blog, we’ll walk you through each step of how to take credit card payments.

In other words, to accept credit cards payments online as a new business, you need two things:

This is the company that processes the transaction.

The three most common options are: 1) a POS system with a card reader, 2) a dedicated card terminal, or 3) a payment gateway (for online shops).

This guide will walk you through how to start accepting credit card payments in person, online, and credit card processing fees you can expect. But generally, if you have a payment processor (or merchant account) and a card reader, you can start. We’ll cover:

A definition of how payment processing works

Advice for choosing a credit card processing company

An overview of the fees you can expect

How to accept credit card payments by business type

Credit card processing involves several steps to ensure a smooth and secure transaction:

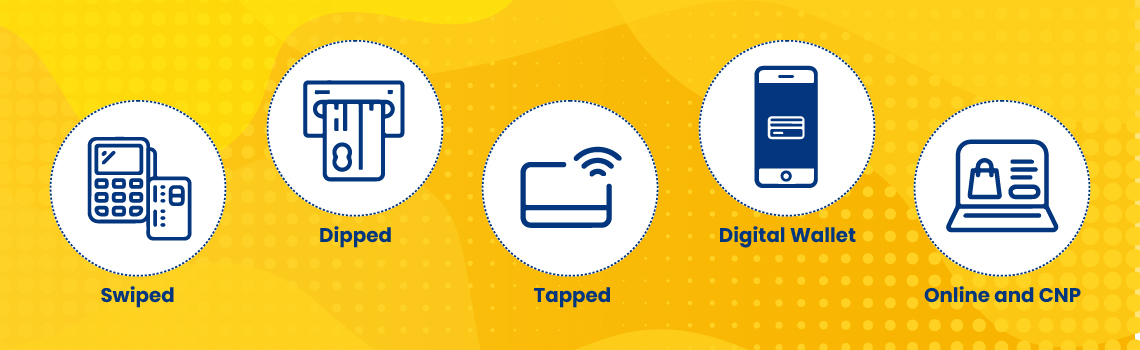

The customer swipes, dips, taps, or enters their credit card information.

The merchant transmits the transaction details to the payment processor, which verifies with the issuing bank if sufficient funds are available and approves the transaction.

Approved transactions are grouped into batches for settlement with the issuing bank.

The issuing bank transfers funds to the merchant’s account minus processing fees.

Several fees are involved in credit card processing, including interchange fees paid to issuing banks and processing fees paid to the payment processor.

Secure communication protocols and encryption are used to protect sensitive credit card information.

In case of disputes or fraudulent transactions, chargebacks may occur where funds are reversed from the merchant’s account.

The transaction is finalized after settlement with the issuing bank.

What do payment processors do?

Learn how payment processors work behind the scenes to process card transactions and fine-tune the best practices of payment processing for businesses.

Read: Integrated Payment Processing: Everything You Need to Know About

The type of processor you work with is dependent on 1) whether you will be selling in-store or online, 2) the transaction volume, and 3) the cards / payment options you want to accept. The most common types of credit card payment processors include:

POS Providers – The best retail POS systems include credit card processing. Payment processing is a feature of the system, along with inventory management tools, CRM tools, and analytics tools.

You don’t need a separate terminal or device to handle credit card and electronic payments. This streamlines the checkout process, reduces errors, and creates a more seamless customer experience.

Payment Gateways – Payment gateways are necessary for accepting credit card payments online. These networks handle the transfer of payment information between the merchant’s website and the credit card network. Authorize.net is an example.

Merchant Account Providers: These are traditional banks or financial institutions that provide businesses with merchant services accounts. This account allows businesses to accept debit card and credit payments. Chase Paymentech is an example.

All-in-One Processors – These systems combine merchant services and payment gateways. These systems are user friendly and require minimal setup. Stripe is an example.

These are just the most common types. For example, a high-risk payment processor is another option, which offers credit card services for businesses in industries with a higher risk for fraud or chargebacks. High-risk providers generally charge higher credit card processing fees. For example, credit card processing for smoke shops may be subject to high-risk fees.

Credit card payments offer a convenient and secure way to pay for goods and services. Here’s a breakdown of the different ways you can use your credit card:

Choosing between a payment provider and a merchant account depends on your business’s priorities.

Payment providers offer easy setup, integrated tools, and flexibility for startups and businesses with limited technical expertise. However, they often have higher transaction fees and limited control.

On the other hand, merchant accounts offer lower fees for larger transaction volumes, customization options for checkout experiences, and direct fund deposits. Yet, they require more complex setup, potentially involving credit checks, longer approval times, and might suit businesses with technical know-how and a need for control. Evaluate your business needs before deciding.

Although competitive rates are a deciding factors, there are many other considerations to make when choosing a processing company. Here are some factors to consider:

Rates – Credit card processors charge fees for each transaction. Don’t just choose the lowest transaction fees; be sure you understand the overall cost and if there are hidden costs like annual fees, minimums, etc.

Reliable Customer Service – A glitch during peak business hours can be disastrous. Ensure your processor is always reachable. (This is also why it can be difficult to work with a large company).

Technology – The best companies utilize the latest security technology, offer tools like NFC scanners for accepting mobile payments, and more. Choose a company that provides access to the latest payment options and advanced payment tech.

Pro Tip. Choose a system with integrated credit card processing in your POS, which is a key benefit of a POS system with integrated processing vs POS + third-party processor. The best marriage is a POS that offers card processing services However, if you choose a third-party payment processor, be sure they offer support for your existing POS system.

There are several ways for businesses to accept credit card payments:

Payment processing costs and fees vary widely depending on the payment provider, the type of transaction, the payment method used, and other factors. Generally, payment processing fees include:

A merchant account includes a monthly fee. These fees include account maintenance charges, statement fees, and/or gateway access fees.

This is a fee for each individual transaction. It can be a fixed fee, a percentage of the transaction amount, or a combination of both. These fees cover the costs of processing the payment.

The card-issuing bank may charge the merchant’s bank a processing fee. Interchange fees vary based on factors like the type of card (credit, debit, rewards, etc.), the transaction method (card-present, card-not-present), and the industry. American Express, for example, has a higher interchange fee.

Card networks charge assessment fees. Typically, these are fixed fees that vary based on the network and the type of card.

Chargeback fees occur when a customer disputes a transaction. Merchants often have to pay a fee for each chargeback to cover administrative costs.

In addition, there are some less common fees you should be familiar with. These fees occur based on the type of account you have:

Cross-Border Fees: If you’re processing international payments, there might be additional fees for currency conversion, cross-border transactions, and compliance with international regulations.

Monthly Minimum Fees: Some payment processors might require a minimum processing volume each month. If your transactions fall below this minimum, additional fees may incur to make up the difference.

Gateway Fees: If you’re using a payment gateway to securely transmit payment data between your website and the payment processor, there might be associated gateway fees.

Additional Services: Some payment processors offer additional services such as fraud protection, subscription management, and reporting tools. These services might come with their own fees.

To get specific information about payment processing costs and fees, it’s best to contact payment processing providers directly and ask for a detailed breakdown of their pricing structure based on your business’s needs.

The cost per transaction that you pay can vary significant. This is generally dependent on the volume of transaction your business does and the provider’s fee structure. However, most credit card processors structure their fees using one of the following methods:

Flat Fee: Some payment processors charge a flat fee per transaction. This fee could range from around $0.20 to $0.50 per transaction, regardless of the transaction amount. This model is common among providers targeting smaller businesses and online startups.

Percentage Fee: The most common structure. Your processor charges a percentage fee based on the transaction amount. This percentage could be around 2% to 3% of the total transaction. This model is good for larger businesses and those with higher transaction volumes.

Tiered Pricing: Some processors use a tiered pricing model where the percentage fee depends on the type of card used for the transaction. The fee might be lower for debit cards and higher for rewards cards.

Interchange-Plus Pricing: This model provides transparency by passing on the actual interchange fees from the card networks along with a separate markup set by the payment processor. This markup is a fixed percentage over the interchange cost, plus a flat fee.

High-Risk Business Fees: If your business is high-risk due to your industry or other factors, you might face higher transaction fees to account for the increased risk. This is common for products like kratom, electronics, or other industries prone to fraud.

Pro Tip. Always be aware of the fees that your credit card processor will charge you. Generally, you’ll want to ask about annual or membership fees, or if there are minimums per transaction. However, you’ll also want to focus on strategies to reduce processing costs, like dual pricing or cash discounts.

Does your POS provider offer credit card processing? If not it might be time to switch. FTx POS offers full-service credit card processing for our customers. With us, you can count on:

For more, contact our team today. We’d be happy to show you how FTx Card Payments can save you money!

Yes, if you have a payment processing system set up, you can accept credit card payments.

You can integrate a payment gateway with your website to securely process online credit card transactions.

In-store transactions typically require a card reader, while online and mobile payments can be processed without a physical machine.

Learn more about this topic. See these related posts on the FTx POS blog.

If you’re still handing customers a swipe-only device or manually typing in card numbers, you’re…

Read More >>Looking for the perfect POS cash register for your business? Whether you’re running a bustling…

Read More >>Running a small business or managing a business-to-business (B2B) operation is tough enough without the…

Read More >>